„Sold her home to pay, no money, crying”

There is an elegant building in downtown Kyiv called the Mandarin Plaza. The ground floor is occupied by spectacular showrooms of luxury brands like Chanel and Dolce&Gabbana. Upstairs: offices. Hundreds of employees come to work each morning to the sixth and seventh floors of the spacious offices of the Milton Group. Young faces, loud music, call center operators on the line all day, contacting customers from all around the world and offering them fantastically profitable investments.

Forrás: Dagens Nyheter

Milton Group is very lucrative. Last year, the company has reached a record revenue of 70 million USD, employees were told by company management at a corporate party held this January. The New Year party was aimed to celebrate the success of Milton. Best performing staff members were rewarded with cars and apartments.

Milton Group has customers from every corner of the world, among them many Hungarians. Most of them are senior citizens. Many entrusted the employees of Milton with all their savings in hope of reaching quick and high profits. But they were wrong. They never got their money back. It appears that, in most of the cases, their money was not invested in anything at all.

It has been three years since Milton is operating uninterrupted. But last year, one of the employees of the Kyiv call center decided that it was enough. The whistleblower spent months gathering information on the operations of the company, then left Ukraine and shared his experiences with the biggest Swedish daily, Dagens Nyheter. Later, a group of investigative journalists came together from all around the world, and Direkt36 was one of the participants. Led by the Organized Crime and Corruption Reporting Project (OCCRP), reporters spent months uncovering Milton Group’s network.

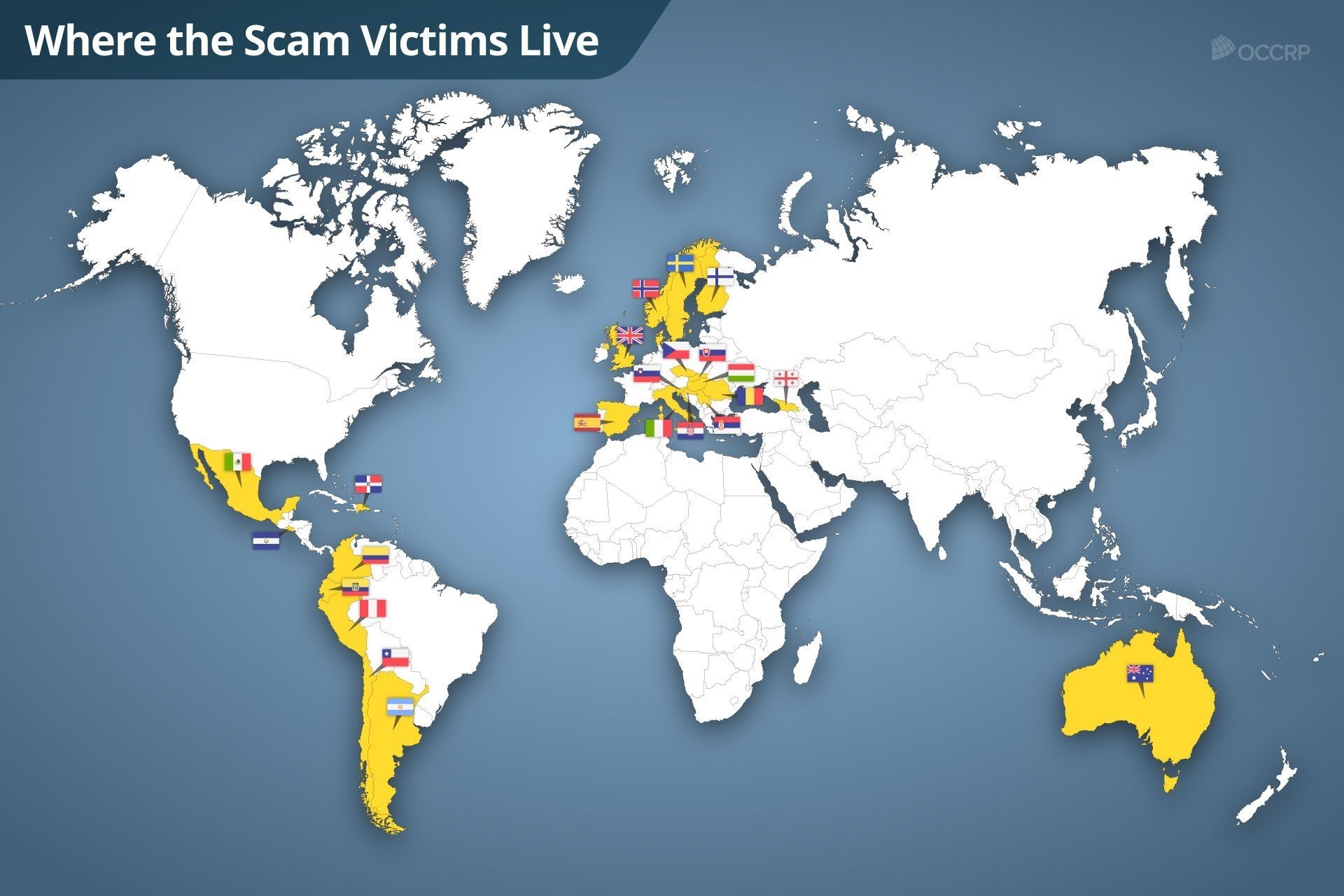

More than a hundred victims from over a dozen countries shared their stories about how they gave their money to Milton people, how they were made to believe that their investments would reach a record profit very soon and finally, how the tricksters disappeared without paying back that money. One Swedish client’s reaction was ruthlessly noted in the company’s records as it reads in the title of this article: „Sold her home to pay, no money, crying”. Another Swedish victim told Dagens Nyheter that she lost more than 40 thousand USD and there is nothing left for her but her grave.

A világ több mint 20 országában élő áldozatok nyilatkoztak. Forrás: OCCRP

Direkt36 has identified more than twenty Hungarian victims, seven of whom agreed to tell their stories. They lost almost 13 thousand USD altogether. One pensioner gave the tricksters the money she had saved for her own funeral and also asked for a loan from friends.

Milton Group CEO Jakub Keselman denies that his company operates a huge call center. He claims that Milton only provides IT and support services to certain brands, meaning Milton has nothing to do with clients. He also said that it happens sometimes that some people lose their investments.

Swedish police have launched an investigation after the whistleblower filed a report. He is now in a safe location outside Ukraine.

Direkt36 publishes two articles on the #FraudFactory investigation. The first piece uncovers the networks’ operations, while the second will tell the story from the Hungarian victims’ perspective.

„This must stop”

Alexey started working in the Mandarin Plaza office last year. He was told that he would be a sales manager at an investment firm. He liked the lively, international atmosphere and the fashionable office building, but something went wrong. At the morning briefing, the head of sales department told the sales managers to squeeze out money from clients at all costs. However, it was unclear what exactly the clients would be investing in.

Alekszej, a forrás. Forrás: Dagens Nyheter.

He had to make 300 calls a day and talk to customers for at least three hours in total, Alexey explained in an interview with Dagens Nyheter. The point was to persuade the clients to open an account with him.

“What are your plans? What are you dreaming of? I can help you reach them.”

He had to say things like this to people to earn their trust. Also, it was advised to create distrust in regular banks, governments or tax authorities. To tell that these would “steal” clients’ money. In comparison, Alexey would have to say that his company offered quick and high profits through experienced brokers.

Call center salespersons did not contact clients on behalf of Milton Group. Instead, they posed as brokers of certain investment brands like CryptoBase, Vetoro Banc, Royal Banc and dozens more.

A Hungarian man has made several investments with various sales managers and brands. However, according to internal documents obtained by the source and viewed by Direkt36, the payments were registered in the same internal system of the Mandarin Plaza call center. The Hungarian man has noticed that his personal accounts on the websites of different brands were identical, but he did not get suspicious at that time.

If the customer got hooked and paid a small amount, at least 50 euros, the sales manager had to create a client profile in Milton’s internal system. The client’s age, desires and habits were registered. Screenshots from the system, seen by Direkt36 showed notes like the following:

“He likes to speak like he don’t care about the money that we make, anyway he will be fucked, god bless him” (Greek victim)

“Very old man/pushed him to get the commission payment….He is at a friend’s home cause he doesn’t have money for food, call him back on Monday, lost 400k” (Swedish victim)

Some were even labeled “not too sexy” or “stupid”. A Hungarian victim’s note read,

“Very old mother fucker doesn’t understand anything”.

After the clients have transferred their first payments, their case was transferred to the retention department. Shortly after being recruited by Milton, it became clear to Alexey that most of the company’s revenues were generated by the retention desk. Retention managers would call customers over the phone, Skype, Viber, or WhatsApp to make them place additional payments. They used several techniques for persuasion.

First, they had to find out how much exactly had the client saved. This was often achieved by persuading their clients to install a remote access program on their computer. There are many applications capable of accessing a remote computer and seeing its screen. These applications are practical to provide IT support or make teamwork more effective. Milton’s retention managers, however, used these applications to show clients how to “trade” money, then asked many of them to enter their personal banking site. This way, they found out about their cilent’s savings and knew exactly how much they could expect from them.

Alexey photographed a salesscript telling sales managers what to do in cases when clients are reluctant or captious, and how to treat clients from certain countries. For example, Northern Europeans “most of the time are old and they really need someone to talk to”. Australians, Britons and New Zealanders “seem to know everything in the world and they [have] great ego” so one should never argue with them, but make them “feel they are important.” People living in continental Europe are “very easy to work with”. “They are always comparing one country within the EU to another.” “Make them understand that they will actually make good returns as profit without paying any cooperate tax.”

The money paid for investments was collected several ways, according to the documents obtained by the source. This is also clear from the accounts of more than a hundred victims interviewed by the group of journalists, including Direkt36, who were working to uncover the story. Some victims were told to simply wire transfer money to a bank account of someone with a Russian-sounding name. It was specifically told them to mark the transaction with the words “private transfer”.

Others had to transfer money to criptowallets. Some victims sent their money to Colombia or Uganda through Western Union. Neither Direkt36 nor other media outlets found traces suggesting that the victims’ money has ever been actually invested. Reporters interviewed more than a hundred people from over a dozen countries who never got their money back.

Meanwhile, the online personal accounts’ sites do not comply with reality. Clients used their online accounts to follow their investments. Seemingly, a few hundreds of euros quickly turned into thousands, which made the clients happy and eager to invest more. According to Alexey, some clients sold their houses, cars or took bank loans. They were unaware of the fact that their online accounts were altered manually by Milton’s staff and that these numbers were fake. After clients had spent all their savings, retention managers stopped contacting them and became unavailable.

The Wolf of Kyiv

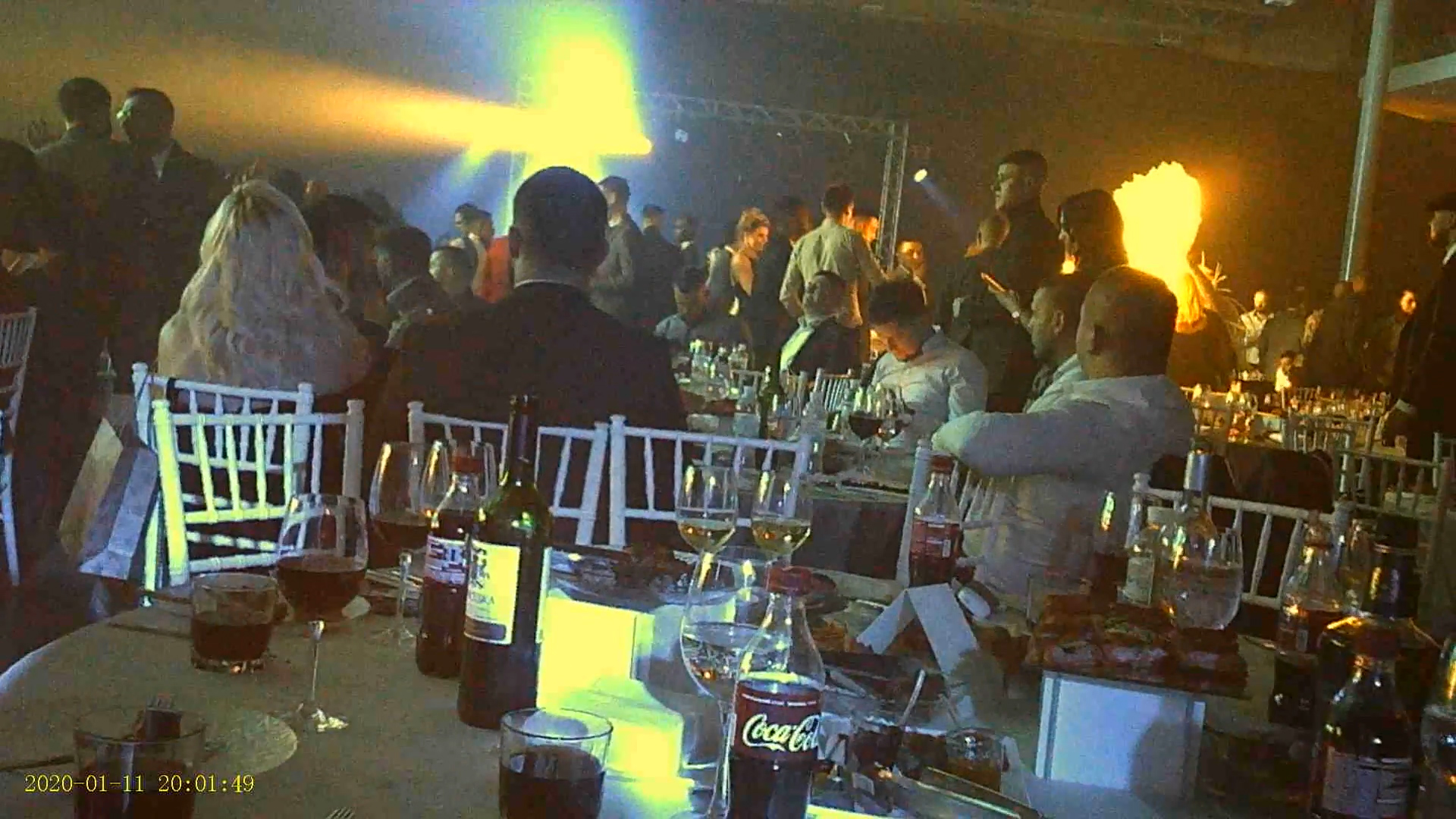

On January 11, 2020, Milton Group held a lavish, Great Gatsby-themed New Year party with hundreds of guests. Dance groups performed amidst roaring music and flashing lights while guests would sip champagne.

A Milton Group január 11-i évindító bulija, a Gatsby Party. Forrás: Dagens Nyheter

The best workers were awarded with apartments, cars and cash rewards. Executives and investors attended. A man named Jakub Keselman appeared on the stage and made a speech. On his Instagram (which is deleted since reporters contacted him last week), he called himself “The Wolf of Kyiv”, possibly referring to the Hollywood movie “The Wolf of Wall Street” which portrays the life of a big investment fraudster.

For Keselman, Milton Group indeed appears to be a very lucrative business. According to his various social media profiles, the newly appointed CEO of the Group likes to pose with luxury cars and go on expensive holidays. In one of the pictures, he is sitting with his laptop in a room with a stunning view of the Eiffel Tower in Paris. Caption reads: “The one who loves his job is truly happy.”

At the Gatsby Party, the spectacular revenues made by the company in 2019 were not the only topic Keselman was talking about. According to a hidden camera footage, he also said: “In December the company turned 3 years old. We are big children. And our dad is proud of us. While we are proud of him. And firstly want to say a big thank you David. And we want to give a cake, because what birthday is without a cake? And David will blow the candle today”, Keselman said in Russian, then applause broke out.

“David” refers to a Georgian-Israeli man named David Todua who owns a Cypriot firm called Naspay, which provides payment processing software solutions to partners. Todua was born in the Soviet Union in 1981 and now resides in Cyprus. While being a businessman he has political ties too: in two of his Kyiv-based companies, his business partner is former Georgian defense minister David Kezerashvili. (Kezerashvili denies having ties to Milton and there is no indication that he is having any.)

Todua loves to pose with guns and cars on social media and a number of security guards follow him everywhere, according to Alexey, who claims to have seen him several times in Milton’s offices. When OCCRP asked him about why is he so heavily guarded, Todua said that it was necessary because of high crime rates in Kyiv.

According to company registries, Todua is not an owner of Milton Group (the Kyiv-based company is officially owned by a person called Dadivadze Irakli who has a Georgian address) and, answering to OCCRP’s questions, he denied being the secret owner of the company. He also added, “I am not the father of any company, I am a proud father of five children”.

However, Todua and Milton do have ties other than him being mentioned in Keselman’s New Year party speech. According to documents from Milton’s internal system, seen by Direkt36, many of the tricked clients used Naspay’s payment solutions service. Todua denied that Milton was a customer of Naspay or that they had any contractual relationship. Another connection is that Todua’s Kyiv companies are also based in the Mandarin Plaza. Todua, however, claims that many companies are operating in that building.

According to its website, one of the partners of Naspay is a Cypriot firm called Axios, in which the majority owner is a Georgian Investor called Rati Tchelidze. Todua bought Naspay from a company where Tchelidze was sales representative. Keselman’s LinkedIn profile shows that he worked not only for Milton but also for Axios. A further link between the companies is that the central phone number provided on Naspay’s Facebook page is the same Cypriot number used when registering Axios’ website.

Jakub Keselman egy céges csapatépítőn. Forrás: Dagens Nyheter

Jakub Keselman not only denied knowing Todua but also denied that Milton held a party in January which he attended. “Maybe you did not see me”, he told Dagens Nyheter. He also claims that it is incorrect that his company defrauded people, because Milton does not deal with investments and does not run call centers. Milton merely provides IT and support services to “brands” running call centers, Keselman said. At one point, however, he expressed his opinion about investments. “A lot of clients lose money because they don’t understand how it’s working. When clients lose money, why do we need to send back money? You understand?” He also insisted that Milton Group did not have an office in Mandarin Plaza. Then he apologized and hung up the phone.

Last week, an investigation was launched in Sweden into the operations of Milton Group. The person who filed a police report was the whistleblower, who had left Ukraine and is now in a safe place. The whistleblower’s plan is to find a new job and tell everything he knows to the police. He is even willing to testify in court.

“I’m sorry for the people who lost their dreams because of them. They cheated them and threw them away. (…) I hope all Milton managers go to hell. That’s what I believe.”

In the next part of our series, we tell the story of the Hungarian victims and the techniques that Milton’s people used when persuading them to invest all their money.

The original photo used for the illustration of this article was made by Alexander Mahmoud/Dagens Nyheter.